PROGRAMME :

Bachelor of Science in Computational Finance (BSCF)

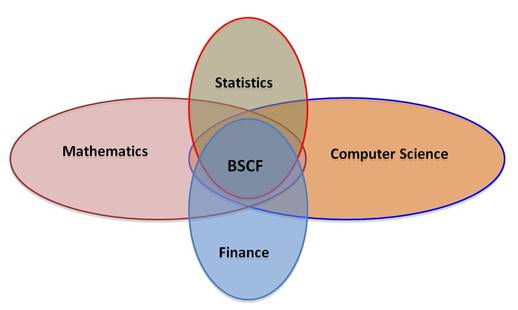

Aims & Objectives:The Bachelor of Science in Computational Finance (BSCF) programme is an applied mathematics programme with a focus on finance being a developed application area. BSCF programme consists of courses in mathematics, finance, probability/statistics, and computer applications.

The BSCF degree is uniquely designed to meet the quantitative needs of the finance industry. This course of study develops an in-depth knowledge of mathematics, probability, statistics, and applications of these disciplines to finance. It uses the tools of mathematics, statistics, and computing to solve problems in finance. Computational methods and the mathematics behind them have become an indispensable part of the finance industry.

Computational Finance is an interdisciplinary field covering both mathematical finance and numerical methods. It emphasizes practical numerical methods and focuses on techniques that apply directly to economic analyses. The BSCF programme includes a solid background in mathematics and statistics, as well as a detailed study of financial mathematics. What makes this degree truly unique is its emphasis on business practices. Graduates of the BSCF programme will have a detailed understanding of the economics that drive financial markets and the ability to thrive in the business environment of the financial industry.

The BSCF programme includes a solid background in mathematics and statistics, as well as a detailed study of financial mathematics. What makes this degree truly unique is its emphasis on business practices. Graduates of the BSCF programme will have a detailed understanding of the economics that drive financial markets and the ability to thrive in the business environment of the financial industry.

Currently the computational finance has become recognized as a distinct academic subfield. It is also sometimes referred to as ‘financial engineering’, ‘financial mathematics’, ‘mathematical finance’, or ‘quantitative finance’.

Applications and Career Opportunities: Over the last 20 years, the field of computational finance has expanded into virtually every area of finance, and the demand for practitioners has grown dramatically. Moreover, many specialized companies have grown up to supply computational finance software and services.

One of the most common applications of computational finance is within the arena of investment banking. Due to the sheer amount of funds involved in this type of situation, computational finance comes to the fore as one of the tools used to evaluate every potential investment, whether it be something as simple as a new start-up company or a well-established fund.

Another area where computational finance comes into play is the world of financial risk management. Stockbrokers, stockholders, and anyone who chooses to invest in any type of investment can benefit from using the basic principles of computational finance as a way of managing an individual portfolio. Running the numbers for individual investors, just alike for larger concerns, can often make it clear what risks are associated with any given investment opportunity. The result can often be an individual who is able to sidestep a bad opportunity, and live to invest another day in something that will be worthwhile in the long run.

In the business world, the use of computational finance can often come into play when the time to engage in some form of corporate strategic planning arrives. For instance, reorganizing the operating structure of a company in order to maximize profits may look very good at first glance, but running the data through a process of computational finance may in fact uncover some drawbacks to the current plan that were not readily visible before.

Being aware of the complete and true expenses associated with the restructure may prove to be more costly than anticipated, and in the long run not as productive as was originally hoped. Computational finance can help get past the hype and provide some realistic views of what could happen, before any corporate strategy is implemented.

A BSCF graduate may also find career opportunities in high performance databases in operational risk management, and measurement is often part of a career in financial technology. Clearing and settling financial transactions is also often a part of a financial technology career.

In summary, the graduates of Computational Finance have brilliant jobs opportunities in Banking sector, Stock market, corporate finance, Collective investment schemes, Credit unions, Investment banks, Pension funds & Trusts etc.

Course Outline:

Bachelor of Science in Computational Finance (BSCF) Scheme of Studies

Bachelor Courses Offered in BE, BCIT & B. Arch Programmes